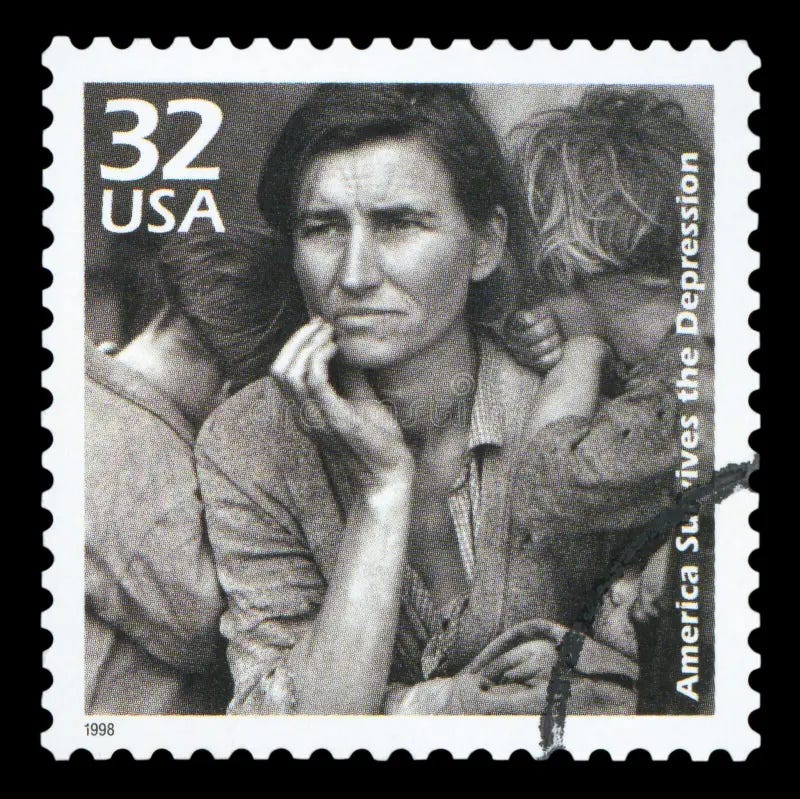

President Reagan touted Florence Owens Thompson, the migrant mother in the photo, when she died in 1983:

“Mrs. Thompson's passing represents the loss of an American who symbolizes strength and determination in the midst of the Great Depression.”

In fact, Florence Owens Thompson’s heritage was Native American (Cherokee), and by written accounts, she lived in abject poverty at least for most of her life—at her death, money was donated by “well-wishers” for her medical bills and funeral expenses. President Reagan’s statement is a myth that still persists today — we continue to project an image of “strength and determination” onto those who manage to stay alive, while poor. The millions of Americans living in poverty in this country are not what we project onto them. They are simply people who cannot support themselves and need help, and we need to increase the amount of help and make it much easier to access if we care about the 38 million Americans currently existing at or below the poverty line.

I thought I’d use this post to reflect on what I’ve learned in nearly two years writing Crime and Punishment, and I hope that I have passed that information to you in a way that you can learn the “why’s” behind the reality of poverty. It is impossible to make change without understanding exactly what should change and why it should change—that’s why facts, particularly when placed in an interesting narrative and historical context (a story!) are important. As citizens living in a participatory democracy, we have an obligation to understand the increasing imbalance of not just money, but the power that money brings, and how an increasing wealth gap directly affects each of us.

Inequality is a drag on economic growth and fosters political dysfunction, experts say. Concentrated income and wealth reduces the level of demand in the economy because rich households tend to spend less of their income than poorer ones. Reduced opportunities for low-income households can also hurt the economy. “When those at the bottom of the income distribution are at great risk of not living up to their potential, the economy pays a price not only with weaker demand today, but also with lower growth in the future,” Economist Joseph Stiglitz writes [PDF]. Council on Foreign Relations, April 20, 2022

The key takeaway from my exploration of poverty in the United States is that its continued existence (despite nearly a century trying to fight it) is directly related to a series of policy choices made by our elected officials through the laws they write. It’s also about how those laws are interpreted and enforced, which appears to be in favor of giving as little as possible to those in need of monetary assistance, including when that money is legitimately allocated for the purpose of alleviating poverty. Truthfully, I have applied for and received most of these programs at different points in my life, so I have seen first hand how they work in practice.

For the most part, poor people cannot lift themselves out of poverty by sheer force of will. And poverty is not a permanent stain on our society because more adults need a two or four year college degree, or that those without money need to work harder and longer, or possess more “strength and determination”. Rather, it is because most of those we elect to represent us and make our laws are operating with antiquated beliefs (like America is great because everyone has the opportunity to “pull themselves up by their bootstraps” and be successful), and in the understatement of our times, our elected officials do not prioritize reducing or eliminating poverty.

There are a number of both federal and state policy choices I’ve written about on Crime and Punishment that have become so completely imbedded into our society that they are rarely questioned. But these areas must be addressed with a view to helping those living in poverty or paycheck-to-paycheck, rather than punishing them.

Credit Scores—Perhaps the greatest Catch-22 in our system, and mostly unregulated. (The three major credit agencies that bring you your credit scores are private, for-profit companies, and the algorithms used to calculate our scores are considered proprietary).

Unless you have oodles of cash under your mattress, you need a high credit score just to function in our society. Most of us cannot pay cash to purchase a home or a car, so we must finance these major purchases. If our credit score is not dubbed “excellent”, we will pay more in interest to finance our mortgage or car loan, or on a personal loan to pay medical debt, which we incurred by having the misfortune to get sick. But the only way to maintain an excellent credit score is to have enough money to pay all of our bills, including credit card charges, at the end of each month and not have to charge too much. How many of us are in that position?

A Federal Usury Law— No one should have to pay 36% to 300% interest on a loan, and the only ones who do are the poor, working poor and perhaps the middle class, who simply don’t have enough cash on hand to cover an emergency.

Personal Bankruptcy Laws—The classic “crime and punishment”. The only reason a person files bankruptcy is because they don’t have enough money to pay their bills. They have committed the crime of not having enough cash and the punishment is ten full years with a negative hit to your credit score. Ten years. Can you imagine getting terribly sick, not having enough money to pay your medical bills, even with insurance, having to go through the cost and humiliation of filing for bankruptcy and then being punished for ten years with a low credit score?1 See #1 above for how important credit scores are for functioning, especially without cash under your mattress.

The truth is that almost all of us have received some type of financial help in our lives, whether it’s gifts or loans from parents, other family or friends, or the government. But for those who don’t have family or friends to lean on during hard times, or aren’t lucky enough to win the lottery or receive a surprise inheritance, the government is our safety net.

___________________________________________________________________________

Let me know your thoughts on this post and some of the others I’ve linked to. You can comment right here.

If you are not already a subscriber, why not take this opportunity to join our community with a free or paid subscription? A new paid subscription or an upgrade from a free to paid subscription will allow me to expand this newsletter with additional, primary source information, like interviews and public information requests, and expanded podcast offerings to include real, live guests. Although I won’t be going on strike any time soon, the current TV writer’s strike demonstrates that writer’s deserve to be paid, and paid well for their work, just like any other profession. Thank you in advance for your financial support of my writing!

66.5% of all personal bankruptcies in 2022 were attributable to medical debt: https://www.retireguide.com/retirement-planning/risks/medical-bankruptcy-statistics/#:~:text=66.5%25%20of%20bankruptcies%20are%20caused,the%20leading%20cause%20for%20bankruptcy.

Share this post