CNBC video on medical debt posted on January 23, 2023. It is well worth your 10 minutes and 39 seconds to watch…

“Neither medical bills nor medical debt should exist in the United States in the twenty-first century. We do not need health insurance of any kind or cost, what we need is quality health care. If you are not wealthy enough to pay the exorbitant costs to for-profit companies to keep you alive and relatively healthy, you are punished with debt, bankruptcy and even your life or those of your loved ones.” The Poverty Trap: Why The Poor Stay Poor In America, December 2. 2022

There have been several new developments with medical debt in America since I wrote about its shocking prevalence one year ago. In that post, I focused on the cost of health insurance — even with Affordable Care Act (AFC) subsidies if one qualified — the cost was too much for average working adults, particularly coupled with higher deductibles and the rising cost of prescription drugs. The unfortunate result is that even with health insurance, whether purchased on the AFC exchange or through an employer, every income group (except the very poor who qualify for and receive Medicaid) has to pay thousands of dollars each year before deductible limits are reached, plus co-pays, prescription drugs that may or may not be covered by a specific plan, and procedures that are increasingly and routinely denied by insurance companies.

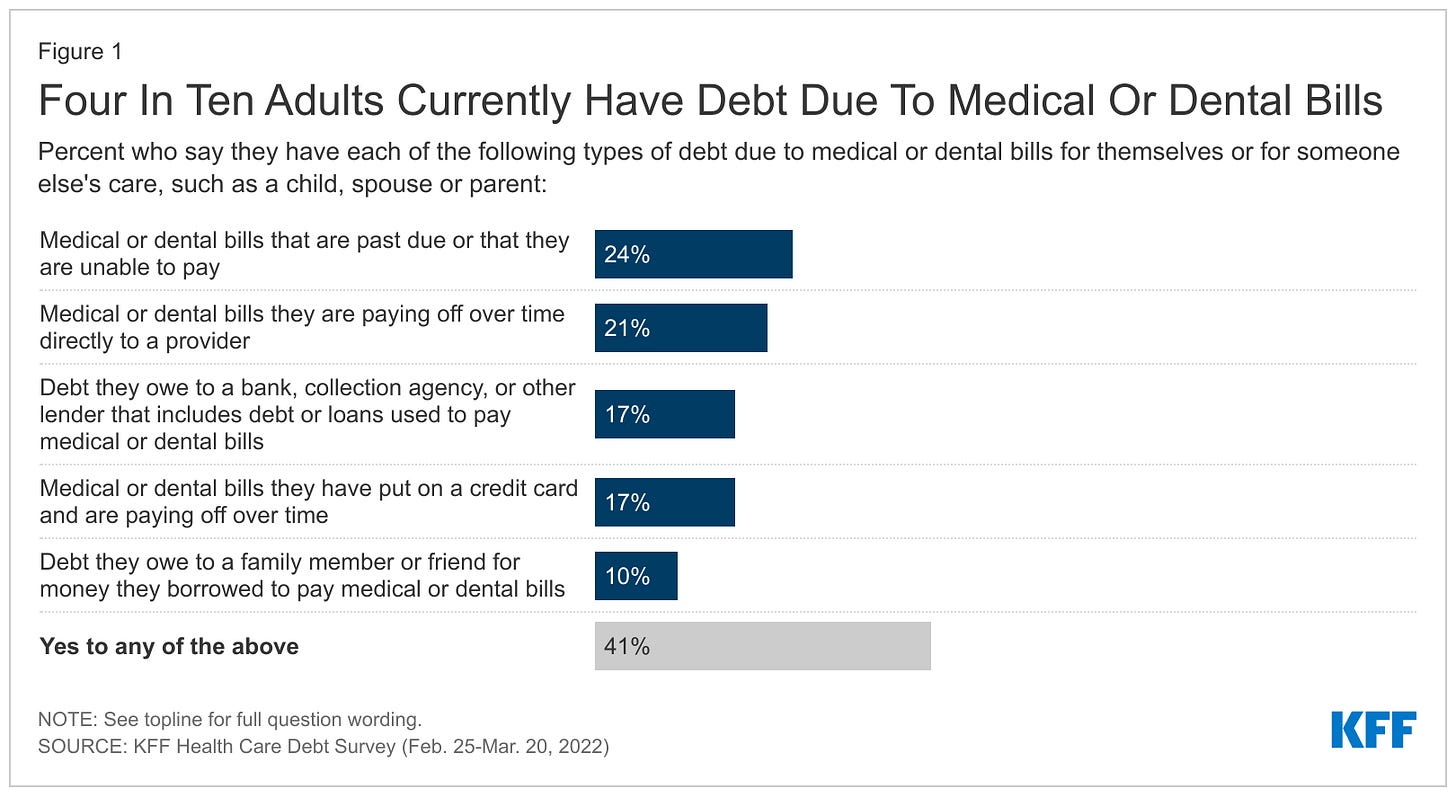

A summary of data compiled in 2022 by the Kaiser Family Foundation (KFF) in cooperation with NPR shows that 41% of Americans have some kind of debt related to medical and dental bills, and this debt is carried in a variety of ways: through payment plans with hospitals or individual doctors; added to credit card balances; transferred to loans, including those taken with payday lenders; borrowing from family and friends; and simply letting the bills go unpaid, even when harassed by debt collectors.

The chart below from the KFF, 2022 survey breaks down the above narrative into percentages by type of debt.

And don’t think that dying will erase your debt, because any cash or other assets of your estate will be used to pay the debt you leave behind, depending on the laws of each state.

In 2022 and 2023, the Biden administration and the Consumer Financial Protection Bureau (CFPB) have worked together to lesson the burden of medical debt for millions of Americans, including forgiving substantial amounts of debt for the poor and veterans, and directing the use of American Rescue Plan funds to individual communities for this purpose. But the underlying issue is how to prevent this specific kind of debt in the first place. Medical debt, unlike other types of debt, is not accumulated through a wild spending spree on luxury goods or Botox injections (well, maybe for a member of Congress or two), it is accumulated through the misfortune of an injury or illness.

Short of calling for “Medicare for all” or a single-payer health care system, the current administration is working around the edges to prevent the accumulation of medical debt. For example, CFPB held a hearing in July 2023 on medical billing and collections and its relationship to medical debt. According to CFPB Director, Rohit Chopra, medical debt isn’t just pervasive and a burden to nearly one third of the U.S. population, it has a massive and detrimental impact on the economy:

“…medical debt impacts approximately 100 million Americans, and national health expenditures account for more than 18 percent of our country’s gross domestic product, with consumers’ out of pocket expenses accounting for a staggering $433.2 billion”.

It turns out that we accumulate medical debt, not only from injuries or illnesses, but from incorrect billing or outright denial of coverage for procedures that should otherwise be paid for by insurance. The CFPB is working with the Departments of Treasury and Health and Human Services to investigate these practices, in addition to investigating consumer complaints filed against special medical card providers for illegal or shady practices. I have a Care Credit card from Synchrony Bank, which is one example of a special use credit card that I use exclusively for veterinary bills.

There are also strict laws on how and when debt collectors can contact debtors and what they can and cannot say to them. But who among us knows these rules and can recall the specifics during a stressful call? It’s hard to stand up for yourself or even know whether you have the legal right to appeal a bill, inaccurate charge or denial of coverage. As noted in my most recent post, less than 0.2% of people with health insurance purchased from the ACA exchange in 2021, whose claim for medical coverage was denied, appealed the denials. Forcing insurance companies to correct their billing practices and pay for covered services and drugs, as the CFPB is currently doing, are specific ways to prevent medical debt.

Statistics show that people who have health insurance can certainly have medical debt, but it is less likely, and the amount of debt is usually substantially lower if a person has insurance of some kind. According to early 2023 statistics from the Department of Health and Human Services, the ACA expanded insurance coverage to over 40 million more Americans than had health insurance before the law was enacted, including to the poorest in our country through an expansion of Medicaid eligibility.

The ACA envisioned a national Medicaid expansion and paid each state no less than 90% of the cost associated with insuring more poor people (The federal government paid a full 100% of the expansion cost for the first several years and then paid a 90/10 split thereafter). But in 2012, the U.S. Supreme Court ruled that each state could make its own decision about Medicaid expansion and not every state chose to accept the federal dollars.

Today, there are 10 states that are holdouts and still refuse to expand Medicaid to insure its poor, and seven of those 10 states are in the South, which also has the highest concentration of the poorest people and those with the most medical debt in our country. See an up-to-date, interactive map from The Commonwealth Fund that provides specifics on each state and their acceptance or non-acceptance of Medicaid expansion here.

To emphasize the southern state concentration with medical debt, the Urban Institute, a non-partisan think tank in D.C, states in a 2023 article in The Washington Post:

Of the 100 counties with the highest share of adults struggling to pay their medical debt, 92 are in the South, and the other eight are in neighboring Oklahoma and Missouri, according to credit data from the Urban Institute. (On the other side, 82 of the 100 counties with the least pervasive medical-debt problems are in the Midwest, with 45 in Minnesota alone.)

This article also helps explain the reason for the medical debt concentration by focusing on where the country’s lowest credit scores are concentrated — in the southern states — and they have the lowest credit scores because they have more medical debt…and one of the reasons the southern states have more medical debt is the refusal of those states to accept Medicaid expansion.

Although the holdout states are still controlled by Republicans, I want to call attention to an outlier: the great state of Ohio. In 2013, then Republican governor of Ohio, John Kasich, bucked his party and approved the expansion of Medicaid in Ohio. And he did so with great fervor, doing an “end around” the state legislature and manipulating the state’s 7 member Controlling Board to approve the expansion. In 2016, the Washington Post wrote a profile of Kasich when he was in his second term as Ohio governor and running for president. Here’s what he said on Fox News about accepting the expansion of Medicaid in Ohio:

“You guys are practically spooning, you and President Obama,” Laura Ingraham said in a Fox News interview with Kasich in November 2013. “That’s amazing. Are you BFFs for real?”

“I’m the CEO of this state,” Kasich responded. “I have a chance to bring [$13 billion] out of Washington to me, to the people here in my state who need this help.”

_________________________________________

I’d love to hear your thoughts on medical debt in America. Should it exist at all? How should we close the gap to at least minimize this type of debt? Please leave your thoughts in the Comment Section below:

Please consider supporting The Poverty Trap with a free or paid subscription. Your financial support will allow me to continue writing this newsletter and expanding it with primary source statistics and podcast interviews. Thank you in advance for your financial support of my writing!

Share this post