“Usury is the act of lending money at an interest rate that is considered unreasonably high or that is higher than the rate permitted by law. Usury first became common in England under King Henry VIII and originally pertained to charging any amount of interest on loaned funds. Over time it evolved to mean charging excess interest, but in some religions and parts of the world charging any interest is considered illegal.”

Investopedia

I don’t think that banks or other lending institutions should be banned from charging some interest on loans, rather it is a matter of how much interest is enough for the lender, and how much is too much for the borrower. Lenders want to make the highest profit possible, so the sky’s the limit on interest rates from their perspective. Unfortunately, the borrower has no control over interest rates…unless millions rise up and demand a federal cap on lender rates, for example, and elected officials listen and respond with legislation. I don’t know if millions of low-wage or average-salaried worker have rallied for a cap, but there is currently a Senate Bill sponsored by the Chairman of the Senate Banking Committee, Ohio’s own Senator Sherrod Brown, and Senator Jack Reed, a Democrat from Rhode Island, to reintroduce the “Veterans and Consumers Fair Credit Act, legislation to extend the Military Lending Act’s 36% interest rate cap to cover veterans and all Americans.” I think this is a good idea and a good start.

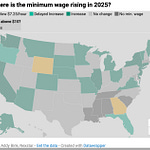

As of July of this year, 18 states and DC have enacted rate caps that supposedly prevent at least the exorbitant rates of payday loans, but a federal law is needed to not only provide consistency, but to close the shocking loopholes in state laws. Although California is one of the states that has capped lender interest rates, this article from the LA Times explains the need for federal legislation by highlighting the major loopholes in its own state law: according to the state’s own attorney general, all of California’s banks, savings and loan, credit unions, finance corporations or even a pawnbroker are exempt from the usury law. It makes you wonder who exactly is covered? Your Aunt Mable?

When I began to get behind on my mortgage and my credit score plummeted as a result, I started to notice lots of personal loan and credit card offers arriving in the mail. I had no idea why lenders were urging me to take on more debt, when I couldn’t pay the debt I already had.

This is why.

I showed you this photo in a previous post discussing the bankruptcy conundrum, and it works just as well here to illustrate what I consider to be a usury interest rate plus fees. The reason I believe 36% to be a usury rate and those on the Senate banking committee don’t, could be because of the cruel irony of our system: those who are already comfortable don’t need to borrow at all, let alone at this rate. If you have enough money to at least pay all of your bills, then you likely have a higher credit score which, in turn, earns you a much lower interest rate if you borrow at all.

The banks target individuals in financial trouble because they know who are desperate for cash or credit. That’s why it’s called “predatory lending”. And by comparison to a “Pay Day” loan which can reach 300% interest or higher, this credit card offer of 36% interest plus annual fees is a bargain.

In addition to credit card offers, I continue to receive offers for personal loans, but this one has a twist: it’s a real check. I also mentioned this scheme in a previous post, because I actually cashed the one I received a few years ago and paid the horrendous interest rate plus fees for well over a year before I was able to pay it off. Fortunately, I’m not desperate for cash at the moment and was able to save this recent offer just to show you a close-up of the interest rates and fees.

If you read the fine print, and you should, you'll see you will owe $95/month for 41 months— that’s three years and five months you will pay just about $100 every month for $2,500 cash now, and you will pay nearly one half of the loan amount in interest and fees.

And although there is no penalty for an early payoff of the loan, the fine print states that if you pay off the loan early, “you may be entitled to a refund of part of the finance charge.” (emphasis added). I guarantee that if you asked the lender what it meant by this statement, you would hear crickets. And because it uses the word “may” and has no additional explanation, it is most likely legally meaningless. In other words, don’t expect a refund. The bank makes sure it gets it’s full finance charge amount, regardless of when you pay off the loan.

In fact, it really doesn’t matter to the lender if you default.

According the the National Consumer Law Center,

“As long as the borrower pays long enough before defaulting, a high-rate installment loan will be profitable. If the borrower makes even half the payments on a longer term high-rate installment loan, the lender may receive sufficient cash flow to recover the amount loaned and another 50% or more, likely more than enough to turn a profit. While the lender may have a successful experience, default causes a cascade of devastating consequences that are likely to plague the consumer for a lifetime.”

Do you think we need a federal usury law that caps lender rates? Should this cap be 36% as proposed in the current Senate bill or even lower? Please share your thoughts in the comment section below.

If you like this post, why not share it with your friends and family?

And please consider a free or paid subscription and here’s why:

Share this post