Friendly Reminder: This is the first post under this newsletter’s new name, The Poverty Trap: Why The Poor Stay Poor In America, and the new url is povertytrap.substack.com (Previously known as, Crime and Punishment: Why The Poor Stay Poor In America) Your transition to the new url will be automatic! See my last post explaining the name and url change here.

And…This post goes out to both free and paid subscribers, but if you are not already a paid subscriber and value this effort and our growing community, please consider upgrading to a paid membership. Thank you!

“The income needed to purchase a starter home has been steadily increasing for over a decade and jumped 13% in the last year alone. As a result, many young people turn to family for help when getting onto the first rung of the housing ladder.” Forbes, August 21, 2023

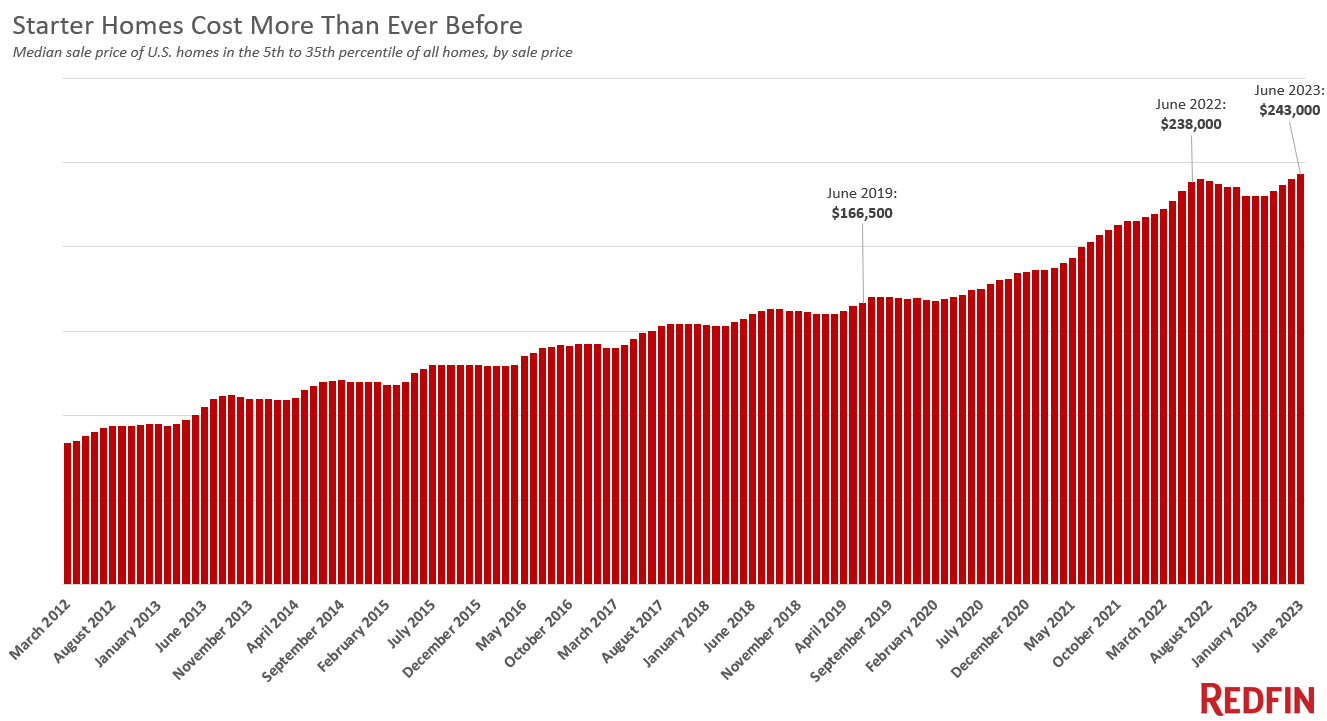

Many Americans are finding it difficult to buy a home in this market, with prices rising, supply dwindling and mortgage interest rates hitting nearly 7%. Younger adults, in particular, find it difficult to purchase their first home—the average price of what today is considered a “starter” home is $243,000, up 13% from last year, and 45% higher than pre-pandemic numbers, according to a June 2023 report by Redfin. Putting 20% down to avoid mortgage insurance and keep monthly payments affordable, means having an extra $48,600 lying around…or more likely, getting help from living family members or receiving an inheritance.

See the upward trend of the cost of starter homes with Redfin’s chart, below.

And plenty of young folks are indeed getting down payment money or other financial help from family. According to a Redfin survey and reported in the Forbes article mentioned above, 38% of buyers under thirty (now dubbed “Nepo-home buyers”) received family help to purchase their first home.

Of course, this is a positive for a good-sized hunk of our next generation because they will begin to build wealth, not only for themselves, but for their children and grandchildren. But those who don’t have high paying jobs and/or help from family are priced out of the market, and at least for now, priced out of the opportunity to build intergenerational wealth. This cycle — families with some wealth getting the opportunity to build more wealth through home ownership — increases wealth inequality in our country and might be the one of the hardest poverty traps to break.

Most of the traditional media I’ve referred to here, give only passing reference, if any, to what forces are limiting the supply of starter homes. One of the major players is Wall Street investment companies that buy up smaller homes in slightly less desirable neighborhoods, almost exclusively with cash offers, and then rent them at exorbitant rates. In the first quarter of this year, investors bought nearly 18% of the starter home market, limiting the supply for individual buyers and driving up prices for the remaining homes for sale.

While investors are purchasing fewer homes than they were before the pandemic, their market share remains relatively high; they bought 17.6% of homes purchased in the metros tracked by Redfin in the first quarter. That’s down from a peak of 20.4% a year earlier but higher than any quarter on record prior to the pandemic. Redfin, May 21, 2023

There is a smidgen of hope, though: investor purchasing of individual homes substantially slowed this year (apparently the market isn’t quite as lucrative as it was during the pandemic), and there has been a rise in private groups attempting to lower housing costs by encouraging more homebuilding.

One of these groups that has had a strong impact in the last few years is “Yes In My Back Yard” or YIMBY’s. The group is a grassroots effort that lobbies municipalities to relax some zoning and permitting standards (often recommending eliminating zoning for single-family homes altogether) in order to build more multi-family units and more affordable housing. And if the acronym sounds familiar, the organization started in part, as a counter to the “Not In My Back Yard” or NYMBY movement that’s been both vocal and successful for decades.

As much as I want to see more homes built, particularly multi-family buildings, as one way to lower the overall cost of home ownership, I worry about the almost certain environmental degradation additional development, coupled with loosening of permitting requirements, will bring. Other ideas, like eliminating (or at least minimizing) investor purchasing of existing, single-family homes, public money directed towards renovating existing homes and neighborhoods and helping those with low incomes to purchase homes with direct subsidies will help ease the housing crisis, too. And spreading the wealth building opportunities of homeowner ownership will help even out the burgeoning inequality gap.

—————————————————————

What are your thoughts on the home ownership crisis we’re having in America? Do you favor additional housing developments to drive down prices? Let me know in the Comment Section below.

Please consider supporting The Poverty Trap with a free or paid subscription. Your financial support will allow me to continue writing this newsletter and expanding it with primary source statistics and podcast interviews. Thank you in advance for your financial support of my writing!

Share this post