Here’s to A Happy and Healthy New Year to you and yours! Thanks so much for your support, and I hope you continue to enjoy The Poverty Trap in 2024.

This post goes out to both free and paid subscribers, but if you are not already a paid subscriber and value this effort and our growing community, please consider upgrading to a paid membership. By the way, our annual sale continues through January 14, 2024—see details at the end of this post!

“It’s the economy, stupid.” James Carville, presidential candidate Bill Clinton’s campaign adviser, sometime in 1992 at the candidate’s Arkansas campaign office.

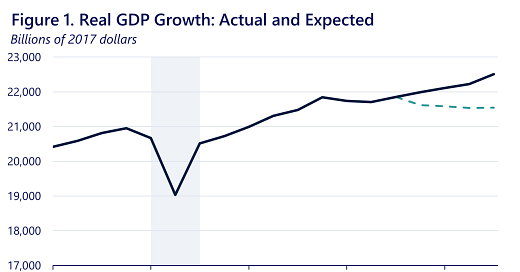

Good news: the economy is recovering much more quickly than predicted even a year ago, inflation is down, unemployment is down and productivity and wages are up. And steady but perhaps slower economic growth, with declining interest rates, inflation and unemployment numbers are predicted for 2024.

The following two charts from the Bureau of Labor Statistics show how the U.S. economy has improved considerably in the last several years.

What is equally important as our rapidly improving economy is the overlap between these economic indicators and the positive environmental news that I wrote about in my last post. It’s almost suspicious, isn’t it, how purposeful government and private sector investments in clean energy, blocking incentives for fossil fuel extraction and use, and reigning in pollution directly lead to improvements in both our economy and environment?

Rather than rely on suspicion or my intuition, I’ve curated a few articles described below that explain our improving economic indicators, and how our growing economy overlaps with the positive environmental news of the past year. I realize that it doesn’t take a Nobel prize-winning economist to see the link between dollar investments in new energy sectors and the creation of new jobs, for example, but with a presidential election looming and rampant “disinformation” crowding our brain space, it’s helpful to see both the facts about the economy and the investments in products and people that helped create these facts.

— First up is an article from U.S. News and World Report stating that consumer sentiment soared at the end of 2023, resulting in increased holiday spending and a boost for retailers and the overall economy.

The final reading of the University of Michigan consumer sentiment survey for 2023 amounts to a Christmas card for the U.S. economy…The university’s consumer sentiment index soared 14% in December – even better than the earlier estimate a couple weeks ago – as consumers reacted to the latest data on inflation that shows it making substantial progress toward the Federal Reserve’s 2% annual target.

Here’s a brief explanation from Britannica Money about what consumer confidence means and how it impacts the economy:

During an economic expansion, consumer confidence is usually high. Consumers accordingly tend to spend more than they do at other times, especially for bigger-ticket items and durable goods (e.g., automobiles and household appliances). The increase in consumer spending in turn helps the economy sustain its expansion.

— This Washington Post article touts the surge in consumer spending in the third and fourth quarters of 2023, which is both a testament to and a bolster of a strong overall economy:

U.S. retail sales between Nov. 1 and Dec. 24 were up 3.1 percent compared with the same period a year before, according to Mastercard SpendingPulse, which measures sales in-store and online across various forms of payment. Online shopping accounted for a large share of the increase, rising 6.3 percent, compared with a 2.2 percent jump for in-person shopping. Apparel sales rose 2.4 percent. Plus, strong demand for in-person dining powered a 7.8 percent jump in restaurant spending.

But the overall expanding economy doesn’t usually “trickle down” to those living paycheck-to-paycheck, and at least some of the spenders that are jump-starting the economy have accumulated massive credit card debt.

— This piece from NPR provides good news for lower wage workers—the minimum wage went up in 22 states starting January 1, 2024. It’s certainly about time that states, cities and local governments have taken the initiative since the federal minimum wage has remained the same since 2009 at $7.25/hour, and the cost of living has skyrocketed in the last 14 plus years.

[These] increases will affect an estimated 9.9 million workers, according to the Economic Policy Institute (EPI), which estimates that those bumped wages will add up to an additional $6.95 billion in pay.

See the full list of increases.In addition to those 22 states, 38 cities and counties will also increase their minimum wages above state minimums on Jan. 1. According to the Department of Labor, 20 states will maintain the federal minimum wage of $7.25 an hour.

Here is a map from the Economic Policy Institute (frequently cited in the NPR piece, above) which highlights the 22 states. You can read the full article with explanation and hover-over map, here.

Again, it is not the work of a brilliant mind to see the overlap between the investments that create an overall robust economy, and those same investments helping to curb climate change and protect our environment from further destruction…but it doesn’t hurt to remind those who vote about the direct connection.

— One of the most important investments is the Inflation Reduction Act, signed into law by President Biden on August 16, 2022. This law allocated $391 billion to environmental improvements, specifically “to support clean energy and address climate change, including $8.8 billion in rebates for home energy efficiency and electrification projects.” You can read the details here, in a handbook published by the White House and updated in September 2023.

It includes billions of dollars in grants to both federal agencies and local governments and organizations to help stem climate change through investments in renewable energy (which creates new jobs and transitions workers who lost jobs in the manufacturing sector), and other incentives to transition from fossil fuels.

The Department of Energy released a comprehensive report in August 2023 that detailed the “significant impacts of both the Inflation Reduction Act and the Bipartisan Infrastructure Law on the U.S. Energy Economy and Emissions Reductions”. You can read the full report here.

[Inflation Reduction Act] IRA and [Bipartisan Infrastructure Law] BIL are poised to save American families $27 billion - $38 billion on their electricity bills from 2022-2030, relative to a No BIL/IRA scenario.

American businesses are also projected to save on their electricity bills, with a 13%-15% reduction in commercial electricity spending between 2022 and 2030. Electricity rates across sectors decline 8%-9% during this period…These factors combine to increase disposable income for Americans families and businesses.

I understand that the current economy is not doing well for everyone — the millions of people estimated to be living paycheck to paycheck can take little comfort in investments in electric cars and renewable energy and the recent holiday spending spree, when the price of food and consumer goods continue to go up, albeit more slowly. But these government and private sector investments will continue to improve our lives in both the short and long term if we understand the effort being made and have patience to see them through.

________________________________________________

I’d love to hear your thoughts on this second round of positive news as we start the new year. Do you feel the improvements in the economy yet? What is your take on the investments in infrastructure, renewable energy and our larger environment? Please leave your thoughts in the Comment Section below!

Share this post